Business Insurance in and around Portland

One of Portland’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

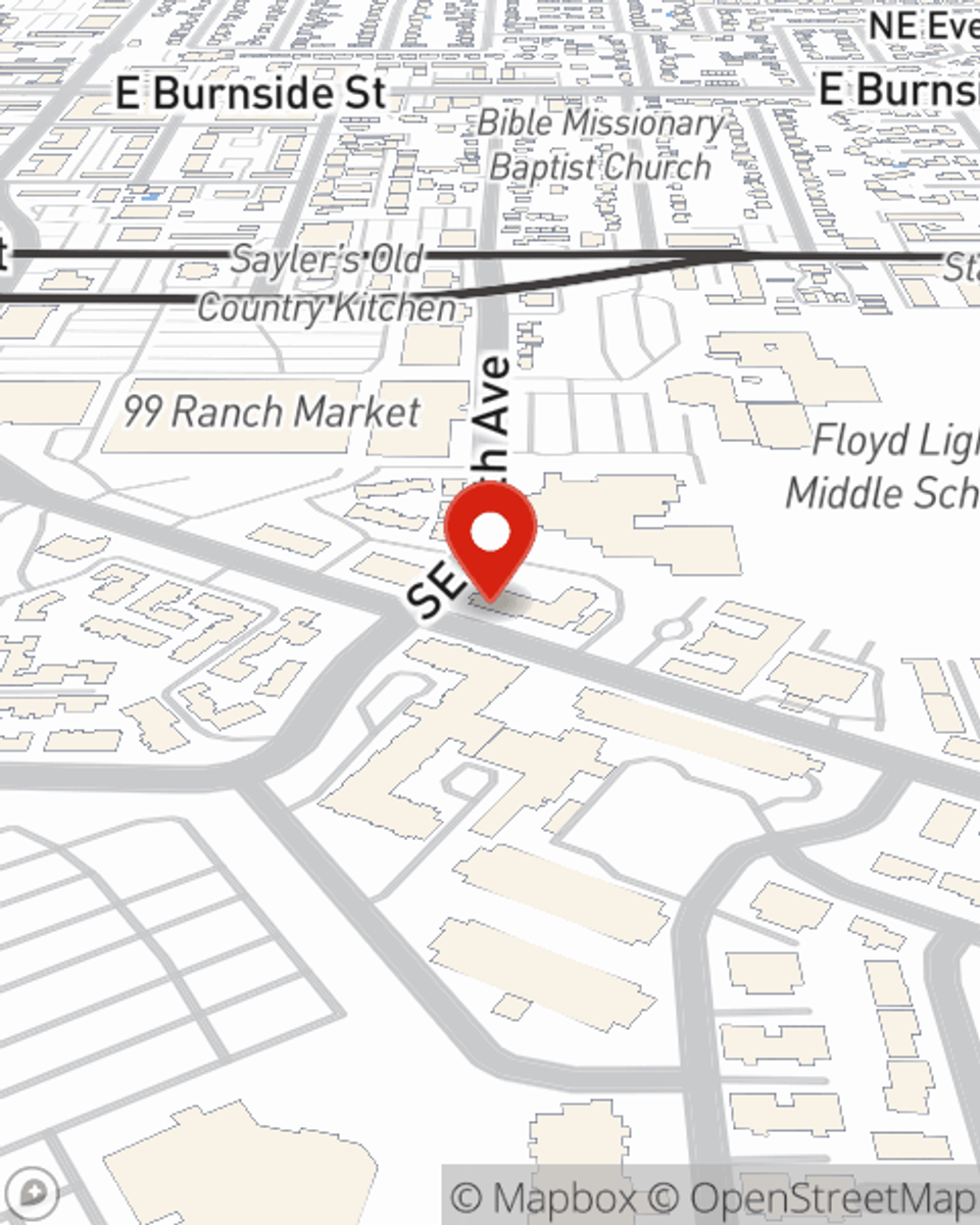

- Portland

- Oregon

- Gresham

- Troutdale

- Happy Valley

- Southeast Portland

- Northeast Portland

- Northwest Portland

- Southwest Portland

- Oregon City

- Milwaukie

- Salem

- Eugene

- Springfield

- Washington

- Vancouver

- Washougal

- Camas

Business Insurance At A Great Value!

As a business owner, you have to handle all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Spencer Hall. Spencer Hall can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

One of Portland’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are a sporting goods store or a real estate agent or you own a vet hospital or a toy store. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Spencer Hall. Spencer Hall is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

It's time to visit State Farm agent Spencer Hall. You'll quickly observe why State Farm is one of the leaders in small business insurance.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Spencer Hall

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.